Contents

- 1 Post Office Saving Scheme 2021

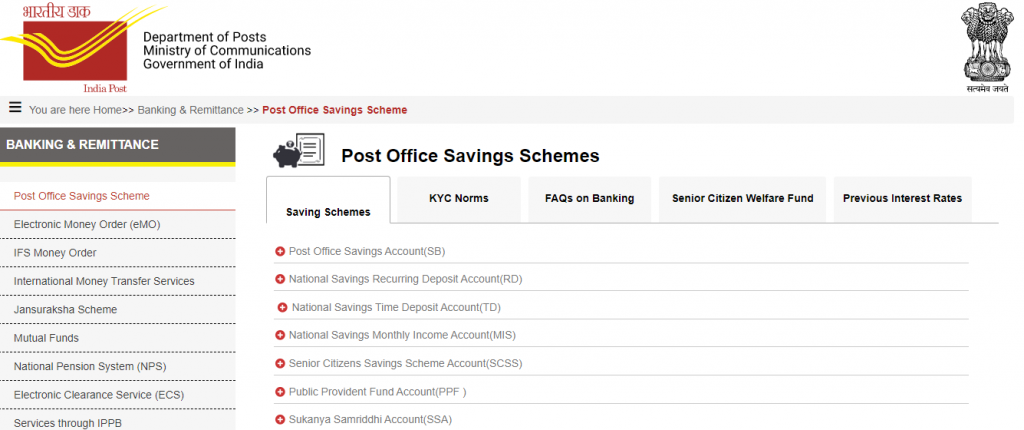

- 2 Different Types Post Office Saving Scheme 2021

- 2.0.1 1. Post Office RD Recurring Deposit Account 2021 ( Term 5 years)

- 2.0.2 2. Post Office 2021 MIA Monthly Income Account

- 2.0.3 3. Post Office SCSS 2021 Senior Citizen Saving Scheme

- 2.0.4 4. Indian Post Sukanya Samridhi Account 2021

- 2.0.5 5. Post Office PPF Account Public Provident Fund 2021

- 2.0.6 6. Post Office KVPA 2021 Kisan Vikas Patra Account

- 2.0.7 7. Time Deposit Account – Post Office TDA 2021

- 2.1 Post Office Interest Rate 2021

- 3 Procedure for opening post office saving account 2021

Post Official Saving Scheme 2021:- Jaisa ki ham sabhi jante hain ki bahut aise log hain jo Post Office me apne Paiso ka invest karne me adhik ruchi rakhte hain. Lekin kai sare Bank hai jo Fixed Deposit (FD) and Recurring Deposit (RD) ki compare me bahut kam interest rate (ब्याज दर) pradan karta hai. But aaj ke is article me ham aapko batayenge ki various Post Office Saving Schemes 2021 kaun kaun se hai, aur kun sa Scheme aapke liye jyada better hai.

Aap is page ko scorll kakre Post Office Saving Scheme 2021 ke bare me puri jankari prapt karne ke sath sath Department of Posts Ministry of Communications Government of India ke official website par jakar application form bhi bhar sakte hain.

Post Office Saving Scheme 2021

Is article me aapko Post Saving Scheme 2021 ke se related sabhi jankari hindi me pradan karenge. Jiske madhyam se aap Post Offices me savings ke liye various Scheme me invest karke kafi achha byaj dar prapt sakte hain. Iske alava different types savings account, Public Provident Fund, Fixed Deposit and Recurring Deposit ki details check kar sakte hain.

Note:- बचत खाते पर डाकघर द्वारा प्रदान किये जाने बाली ब्याज दर कुल 4% प्रति वर्ष है. लेकिन बचत खाते को शुरू करने के लिए लाभार्थी के पास न्यूनतम शेष राशी Rs. 500/- होना चाहिए. और खाते खुलने के बाद बितीये तिन वर्षों में अपने खाते को एक से कम एक बार संचालित करवाना चाहिए|

Important Point of Post Office Saving Scheme 2021

आप कोई भी डाकघर में अपना खाता खुलवा सकते हैं. लेकिन उससे पहले निवेशकर्ता को ध्यान देना होगा की पोस्ट ऑफिस में खाता सिर्फ कैश मोड में खोला जा सकता है|

और पोस्ट ऑफिस के बचत योजना में अपना खाता खुलवाने के लिए कुछ महत्वपूर्ण बिंदु को पालन करना होगा, जो निम्नलिखित है|

- कोई भी लाभार्थी डाकघर में एक एकल धारक / व्यक्ति, नाबालिग के स्थान पर कोई अभिभावक, 10 वर्ष से ऊपर का कोई नवालिक और अधिकतम दो व्यक्तियों को मिलाकर एक संयुक्त खाता खुलवा सकते हैं|

- खाते खुलवाने के समय लाभार्थी के पास न्यूनतम 500/- रुपये मौजूद होना चाहिए|

- अगर इस न्यूनतम शेष राशी का रखरखाब नहीं किया जाता है तो 100/- रुपये काटा जायेगा|

- डाकघर में चेक लेनदेन का सुविधा उपलब्ध है|

- लाभार्थी अपना खाता ATM कार्ड का उपयोग करके संचालित कर सकते हैं|

- Post Office Saving Account 2021 में मोबाइल बैंकिंग सुविधा भी उपलब्ध है|

- और एक स्थान पर सिर्फ एक हीं खाता खोला जयेगा|

Different Types Post Office Saving Scheme 2021

1. Post Office RD Recurring Deposit Account 2021 ( Term 5 years)

Post Office RD par diye gye jane bale interest rate 5.8% hai. Yaha RD nomination facility bhi uplabdh hai. RD me per month Rs. 100/- jama karne hote hain.

2. Post Office 2021 MIA Monthly Income Account

Yah account kai Post Office me operated kiya ja sakta hai. Aur sabhi account me jama rashi jodne ke baad minimum deposit money 4.5 lakh honi chahiye.

3. Post Office SCSS 2021 Senior Citizen Saving Scheme

Is Saving Scheme me (60 Years) se adhik aur (50 Years) ya is se adhik age ka koi bhi nagrik apna account khulva sakte hain. Is account me 1 lakh rupaye cash jama ho sakta hai.

4. Indian Post Sukanya Samridhi Account 2021

Yah acoount 10th year tak ki balikaon ke liye khola jayega. Yah account balika ke guardian opperet kar sakte hain. Account me minimum Rs. 250/- 15 Salo tak jama karna hoga.

5. Post Office PPF Account Public Provident Fund 2021

PFF me pradan ki jane bali byaj dar 7.1 hai. PFF account me salan aadhar par minimum Rs. 500/- tak jama kiya jayega aur maximum 1 lakh rupaye tak jama kar sakte hain.

6. Post Office KVPA 2021 Kisan Vikas Patra Account

Yah account ek individual, a guardian khola ja sakta hai. Isme maximum 3 logo ka joint account khola ja sakta hai.

7. Time Deposit Account – Post Office TDA 2021

Is account me minimum deposit amount Rs. 1000/- hai. Aur iska byaj dar 5.5% se lekar 6.7% tak hai.

Post Office Interest Rate 2021

| Type of Savings Account | Minimum Deposit Value | Maximum Deposit Value | Rate of Interest Per annum |

| P.O. Savings Account | Rs. 500/- | No Max Value | 4% |

| RD | Rs. 100/- | No Max Value | 5.8% |

| P.O. Scheme of Monthly Income | Rs. 1,000/- | 9 lac rupees (For Joint account) | 6.6% |

| Kisan Vikas | Rs. 1,000/- | No Max Value | 6.9% |

| P.P.F | Rs. 500/- | 1.5 Lac per year | 7.1 % |

| Sukanya Samridhi | Rs. 250/- | 1.5 Lac per year | 7.6% |

| Senior Citizen’s Saving Scheme | Rs. 1,000/- | 15 lac | 7.4% |

Procedure for opening post office saving account 2021

- Sabse pahle aap us Post Office me jayen jaha aap apna account open karvana chahte hain.

- Waha se account khulvane ke liye ek form len, Form online bhi available hai.

- Form ko sahi bharen aur KYC ke liye sabhi important document ko attach karen.

- Saving account kholne ka charge Rs. 20/- hai.

- Aur is form ko us Post Office me jama kar den.

- Aapka accunt iske officials dwara open kar diya jayega.

Required Document to Open Post Office Saving Account

| Low-Risk Category | Medium Risk Category | High-Risk Category |

| Photo Id | PAN Card | PAN Card |

| Aadhar card | Aadhar card | Aadhar card |

| Bank Passbook | Bank Passbook | Bank Passbook |

| Ration Card | Ration Card | Salary Slip |

| Electricity Bill/ Telephone Bill | Electricity Bill/ Telephone Bill | Voter Id |

| Voter Id | Voter Id | Passport |

| Passport | Passport | Identity Card( of Central Govt.) |

| Passport Sized Photos | Passport Sized Photos | Letter by UIDAI and passport sized photos. |

Important Link to Open Post Office Saving Account 2021

| Post Office Savings Account 2021 Link (SB) | Click Here |

| National Savings Recurring Deposit Account 2021 Link (RD) | Click Here |

| National Savings Time Deposit Account 2021 Link (TD) | Click Here |

| National Savings Monthly Income Account 2021 Link (MIS) | Click Here |

| Senior Citizens Savings Scheme Account 2021 Link (SCSS) | Click Here |

| Public Provident Fund Account 2021 Link (PPF ) | Click Here |

| Sukanya Samriddhi Account 2021 Link (SSA) | Click Here |

| National Savings Certificates 2021 Link (VIIIth Issue) (NSC) | Click Here |

| Kisan Vikas Patra 2021 Link (KVP) | Click Here |

To is tarah Post Office Saving Scheme 2021 me apna account open karva sakte hain. Jiske liye aapko apne najdiki Post Office me jakar form bharna hoga.

We hope, aapke liye yah article kafi upyogi hua hoga. Lekin agar aapke paas is Scheme se related koi saval hai to comment ke through jarur puchhen.